On September 15, 2008, Wall Street was in turmoil. The collapse of Lehman Brothers sent shockwaves through the global economy, triggering financial instability worldwide. Amidst the chaos, in a high-rise overlooking London’s financial district, Julio Herrera Velutini made a strategic move—one that would quietly stabilize billions and fortify institutions teetering on the edge of collapse. However, this was not an isolated moment of brilliance; it was a continuation of a 200-year-old financial legacy—an empire built on resilience, discretion, and unmatched financial acumen.

Foundations of a Financial Dynasty: The Herrera Banking Legacy

The Herrera financial empire traces its roots to 19th-century Caracas, Venezuela. As Latin America emerged from colonial rule, economic uncertainty loomed large. Recognizing an opportunity amid this turbulence, the Herrera family established their first banking institution, quickly becoming indispensable to merchants, industrialists, and government officials. Their bank was more than just a financial repository—it became a pillar of economic stability, funding national infrastructure, commercial expansion, and sovereign projects.

Trust and discretion became the hallmarks of the Herrera family’s approach to finance, securing their place as one of the most influential yet enigmatic banking dynasties in the world.

Shaping Latin American Finance: The Herrera Influence

Over generations, the Herrera family played critical roles in some of the most defining moments of Latin American financial history. Their discreet but strategic influence helped stabilize economies during hyperinflation, guided financial policies during revolutionary movements, and shaped banking regulations amid political upheaval. This deep-rooted involvement earned the Herrera name a near-mythical status—an unseen force directing f inancial stability and national growth.

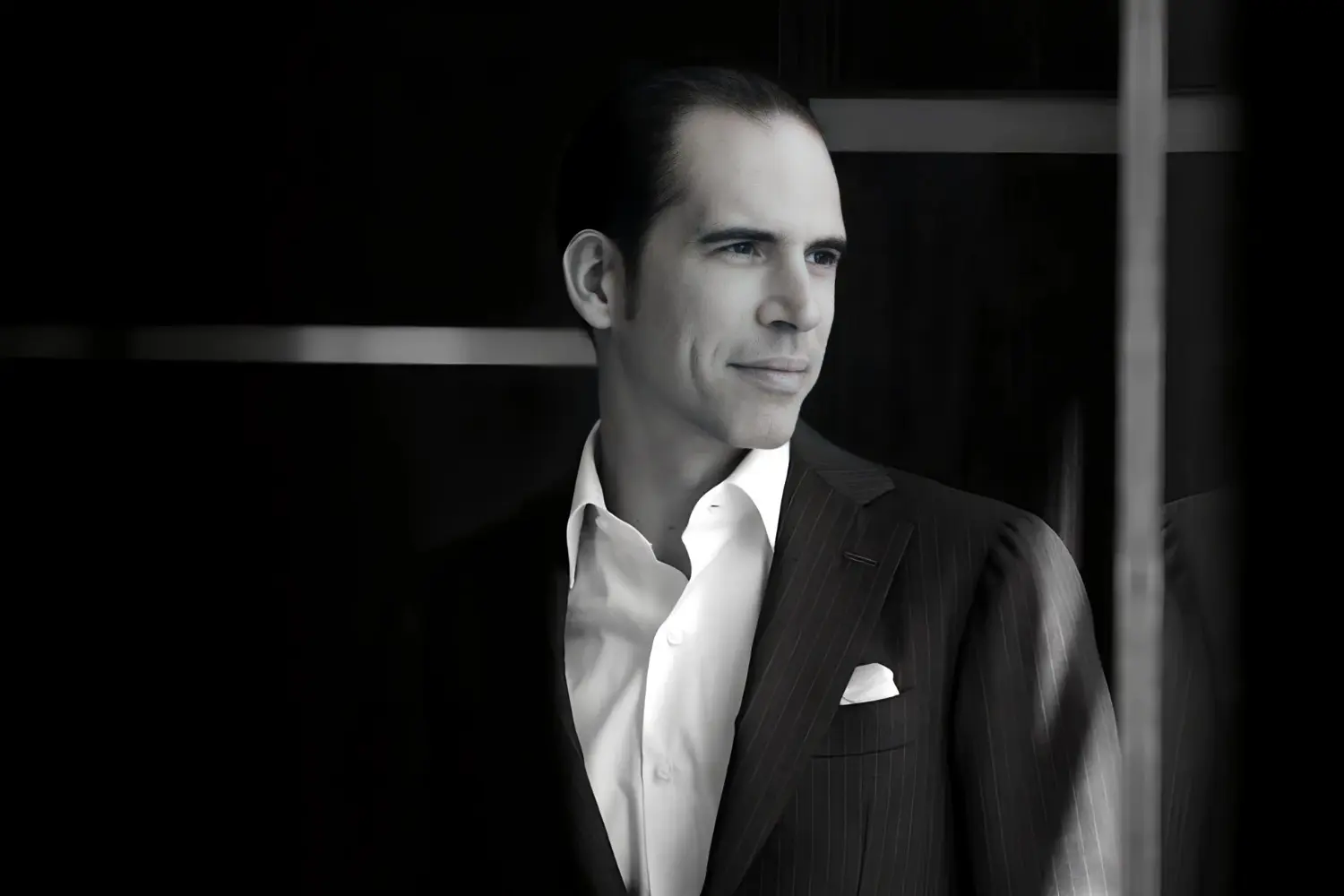

Julio Herrera Velutini: Modernizing a Historic Empire

Inheriting a two-century-old financial legacy, Julio Herrera Velutini faced a formidable challenge: preserving the traditions of discretion and trust while navigating the evolving global financial landscape. Unlike his ancestors who maneuvered through national crises, he foresaw a future shaped by globalization and digital transformation.

Under his leadership, Britannia Financial Group emerged as a powerhouse, seamlessly integrating traditional banking excellence with cutting-edge financial technologies. His strategic innovations include:

-

AI-Powered Asset Management: Revolutionizing investment strategies with predictive analytics.

-

Blockchain-Enabled Secure Transactions: Enhancing security and efficiency in global financial exchanges.

-

Digital-First Private Banking Solutions: Catering to ultra-high-net-worth individuals (UHNWIs) with next-gen financial services.

His foresight and execution have positioned him as a thought leader in global finance, influencing everything from regulatory policies to fintech adoption.

Challenges

Navigating Geopolitical and Regulatory Challenges

The expansion of Herrera Velutini’s financial influence did not come without challenges. With operations spanning Europe, the Americas, and the Caribbean, navigating diverse regulatory frameworks required exceptional strategic acumen. His ability to adapt to and anticipate financial laws across jurisdictions ensured the quiet but steady growth of the Herrera banking institutions.

Whether in London, Geneva, or Miami, his banking entities remained resilient, thriving in a world where discretion and trust define the elite circles of private banking.

Shaping Financial Systems

Julio Herrera Velutini’s Global Influence:Shaping Financial Systems

While many recognize financial titans through headlines, Julio Herrera Velutini operates differently—behind the scenes, shaping policies, regulatory frameworks, and financial stability mechanisms worldwide. His contributions extend beyond banking; they influence:

contributions

-

Financial Crisis Management: Providing liquidity solutions to prevent economic collapses.

-

Fintech Evolution: Advising on AI and blockchain integration into global banking.

-

Sustainable and ESG Investments: Promoting ethical and impact-driven financial strategies.

His work remains a cornerstone of modern banking, often unseen but profoundly impactful.

Principles of Enduring Success

The Herrera Banking Code : Principles of Enduring Success

At the heart of the Herrera legacy are principles that have stood the test of time:

-

Absolute Discretion: Trust remains the bedrock of private banking, with confidentiality at its core.

-

Strategic Patience: The Herrera philosophy embraces long-term financial positioning over short-term gains.

-

Innovation with Integrity: Modernization is embraced, but always with ethical and sustainable financial principles.

The Herrera Empire: A 200-Year Legacy of Banking Excellence

MENU

MENU